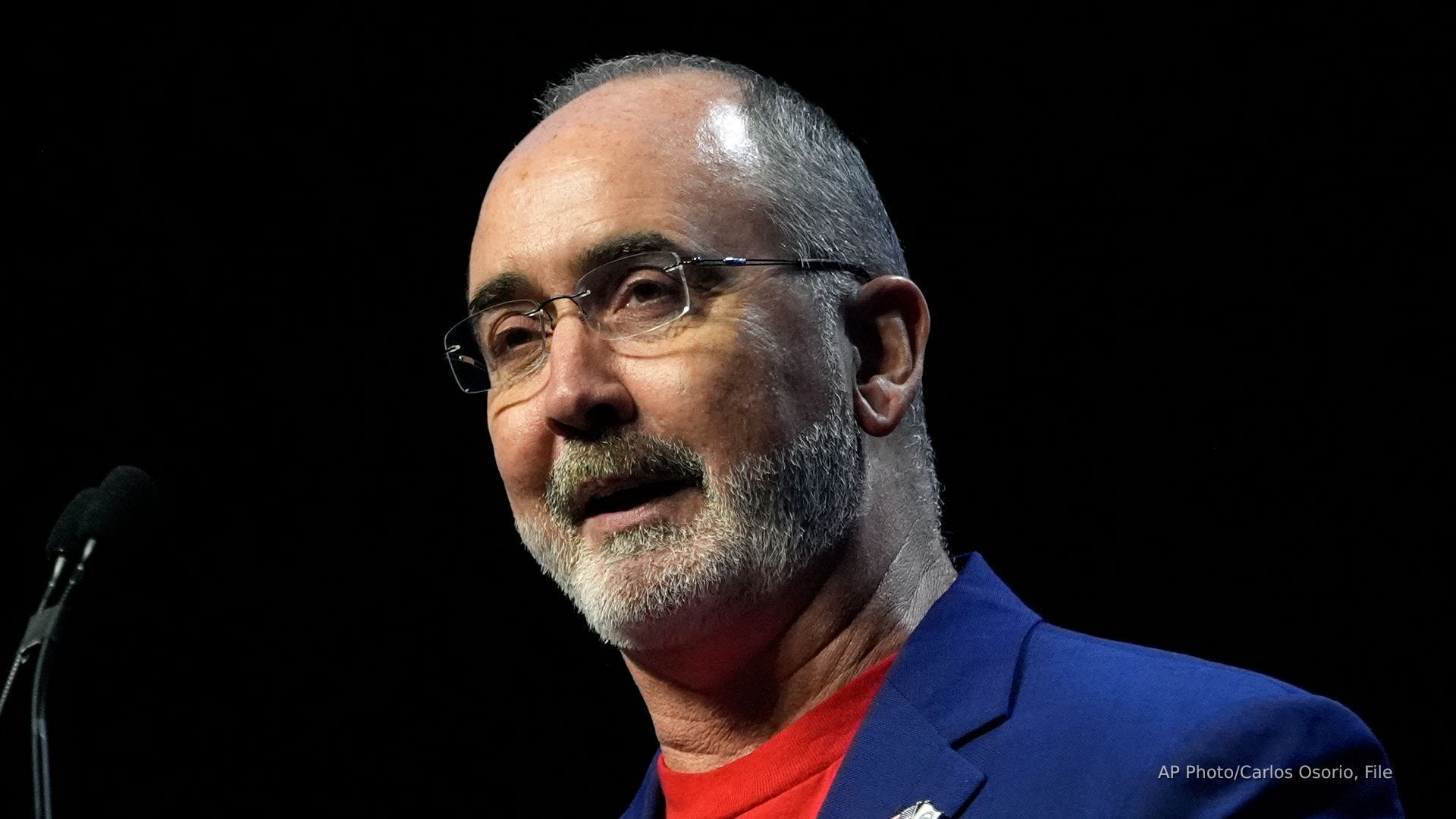

UAW president Shawn Fain supports Trump’s auto tariffs

The president of the United Auto Workers union is praising President Trump’s tariffs on foreign-made vehicles, but says it can’t stop there.

Straight Arrow News

- Prices on high-demand cars could go up within a month, due to tariffs, one report states.

- Consumers likely to pay more as tariffs spread across cars and other goods.

The Trump tariff tsunami is about to hit the economy in ways most of us cannot imagine.

Wall Street is bracing for a possible rough day in trading Thursday, as traders digest sweeping tariffs announced by President Donald Trump after the trading day ended Wednesday afternoon. As part of the news, Trump announced a 26% tariff on imports from India and a 34% tariff on imports from China and a 20% tariff on imports from the European Union.

Just how high sticker prices will go on new cars and trucks is anybody’s best guess once the auto industry adjusts to the steep tariffs that the president put into place starting April 3. Tariffs on auto parts will hit no later than May 3.

It’s important to note that estimates are just that, estimates. We don’t know what we don’t know just yet as this whole tariff saga unfolds.

Wide range of price hikes likely on cars, SUVs and trucks

The East Lansing-based Anderson Economic Group released a revised estimate on Wednesday, which spells out a wide range of potential tariff-related costs for some cars, SUVs and trucks.

The extra tariff-related cost is estimated to range from $2,500 to $4,000 for some small crossovers, sedans, and one midsize SUV assembled in the United States, according to the report. The Honda Civic and Honda Odyssey had high U.S. content and one of the lowest tariff costs in the group. The Chevy Malibu, VW Jetta, and Ford Explorer are also in this group, but the Anderson report said those vehicles were less impacted by tariffs.

Yet we could see a $5,000 to $8,500 jump in costs due to tariffs, the report noted, when it comes to many midsize vehicles, including a passenger van, an SUV, and some pickup trucks. Some Jeep, Ram, and Toyota truck models are in this category, as are the Chrysler Pacifica van, and the Ford Bronco Sport.

The tariff impact would climb to $10,000 to $12,000 per vehicle for the expensive, large SUVs that include models assembled in the United States with parts from Canada, Mexico, and Europe. Some electric vehicles could see an impact of $15,000 or more. Models in this group include the Chevrolet Suburban, GMC Yukon, Cadillac Escalade, and BMW X5, as well as the Ford Mach-e.

The Anderson Economic Group pointed out that list prices and content on vehicles in the large SUV category vary considerably, as will the tariff impact on specific models.

Patrick Anderson, CEO of the Anderson Economic Group consulting firm in East Lansing, told the Detroit Free Press that the cost of tariffs will be a bad story from the consumer’s perspective.

“It’s a huge amount of money that gets imposed on consumers and producers in one year.”

The group says that the U.S. consumer impact is estimated at $30 billion for first full year. And Anderson said the cost could even be as high as $70 billion if you factor in the added costs that manufacturers, dealers and others will take on due to auto-related tariffs.

Anderson said manufacturers are going to be doing their best to insulate consumers as much as possible, and not just raise prices based on the full cost increase due to tariffs.

But he said he’d expect that prices will go up soon. Higher prices could hit in-demand models within a month, according to the report. When dealers have a substantial inventory of a given model, though, cost increases could be delayed by two months or more.

Luxury will mean an even more luxurious price tag, as high-end sedans, SUVs, and sports vehicles could face a potential tariff exceeding $20,000 based on this report. The group includes vehicles manufactured by Audi, BMW, Jaguar-Land Rover, Mercedes-Benz, Genesis, and Lexus.

Anderson said he’d expect automakers to pass most, if not all, the higher tariff costs onto well-off consumers who are already willing to spend more than $150,000 on some premium brands. Many of those consumers know what they want, he said, and they could very well be willing to pay more.

Manufacturers can be expected to absorb some, but not all, of the tariff costs in the first year, Anderson said. But eventually, he said, manufacturers will adjust production and shift nearly the entire costs of the tariffs onto consumers.

All isn’t certain, though, as to what happens next when it comes to pricing and production.

Uncertainty remains on some specifics relating to auto parts

Gabriel Ehrlich, director of the University of Michigan’s Research Seminar in Quantitative Economics, said Wednesday that many unknowns remain relating to auto tariffs, even though Trump’s March 26 proclamation calls for a 25% tariff on imported autos that will be applied April 3.

What remains unclear is what specific parts and components now built outside of the United States might end up being exempt from tariffs, Ehrlich said. Trump’s 25% tariffs on automobile parts are due to take effect no later than May 3, according to the president’s proclamation.

Ehrlich said it also remains unclear how much negotiation will be involved in the days ahead to avoid or deal with retaliatory tariffs from other countries.

Some automobile parts could qualify for special tariff treatment if they qualify for preferential treatment under the United States-Mexico-Canada-Agreement. The Secretary of Commerce, in consultation with the U.S. Customs and Border Protection, will need to establish a process to apply the tariff exclusively to the value of the non-U.S. content of such automobile parts, according to the president’s proclamation.

Michigan’s economy likely to feel the squeeze

Michigan’s manufacturing base, Ehrlich said, could benefit over time as some automobile assembly and the production of auto parts return to the United States. But that rebuilding would take time.

Even so, he said, the net effect for Michigan’s economy is likely to be negative as producers and consumers take on added costs, and other countries retaliate with their own higher tariffs on U.S. goods. Short-run disruptions could also be particularly difficult as supply chains take time to adjust, he said.

While some scenarios exist where the net effect for Michigan could be positive, Ehrlich said, the realistic possibility of trade retaliation from other countries would be damaging and contribute significantly to a net negative for Michigan.

Auto suppliers unlikely to make big moves back to United States

Dan Sharkey, a local attorney whose firm represents roughly 90 auto suppliers from multinational suppliers to small shops, said he would not expect any auto suppliers with plants in Mexico or Canada to simply decide to close huge facilities and build factories in Kentucky, Michigan or elsewhere in the country.

Sharkey, a co-founder of the Brooks Wilkins Sharkey & Turco law firm in Birmingham, said auto suppliers must factor in that it can take two or three years to realistically move operations to a new factory in the United States.

By then, he said, those business owners would have about a year left under the Trump administration. Trump cannot run for a third term under the limits set in the U.S. Constitution.

“And who knows what the new rules are going to be?” he said.

“This is the environment we’re in,” he said, “where things change by the hour.”

What some companies might do, he said, is take a tool from a Mexico plant now and send that work back to their factory that already exists in the United States. “Just put it on a truck, transport it, and in a couple weeks, you get approved, and you’re making parts,” Sharkey said.

It’s a much smaller economic impact than moving entire operations from one country back to the United States.

“I’ve not heard of a single supplier who said ‘Yeah, I’m gonna pick up this entire plant or this entire facility, shut it down and rebuild a new one in the U.S. because I’ve got to jump because President Trump said I’ve got to jump,’ ” Sharkey said.

What auto suppliers are more likely to do, he said, is max out their U.S. production. And they’re going to pass along those costs to manufacturers, who will pass along costs to consumers.

“I don’t know of a single supplier who says ‘I can pay a 25% tariff. No problem,’ ” Sharkey said.

No doubt, consumers will pay more as the tariffs continue. Exactly how much more for each vehicle we will find out over time. But the early reviews aren’t looking good.

Contact personal finance columnist Susan Tompor: [email protected]. Follow her on X @tompor.